📖 Introduction

In the forex market, currencies are always quoted in pairs. Understanding how currency pairs work and how pips are calculated is essential for every trader. This guide breaks down common currency pairs, pip definitions, and how these concepts impact trading decisions.

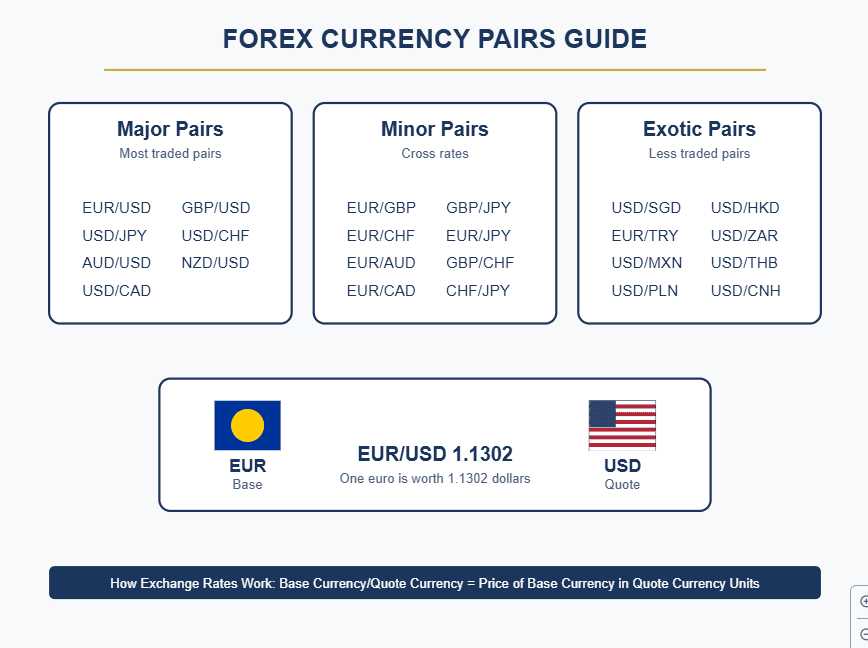

💰 What Are Currency Pairs?

A currency pair represents the value of one currency relative to another. In every forex transaction, traders are simultaneously buying one currency and selling another.

🔍 Types of Currency Pairs

- 🌍 Major Pairs: Most traded pairs, including the US dollar (e.g., EUR/USD, USD/JPY).

- 💹 Minor Pairs: Common pairs excluding the US dollar (e.g., EUR/GBP, AUD/NZD).

- 🌐 Exotic Pairs: Major currency paired with a developing market currency (e.g., USD/TRY).

💱 Base & Quote Currency

- 💡 Base Currency: The first currency listed in a pair (e.g., EUR in EUR/USD).

- 🔄 Quote Currency: The second currency that measures the value of the base currency (e.g., USD in EUR/USD).

📊 Example Calculation:

EUR/USD = 1.1234 means 1 Euro equals 1.1234 US Dollars.

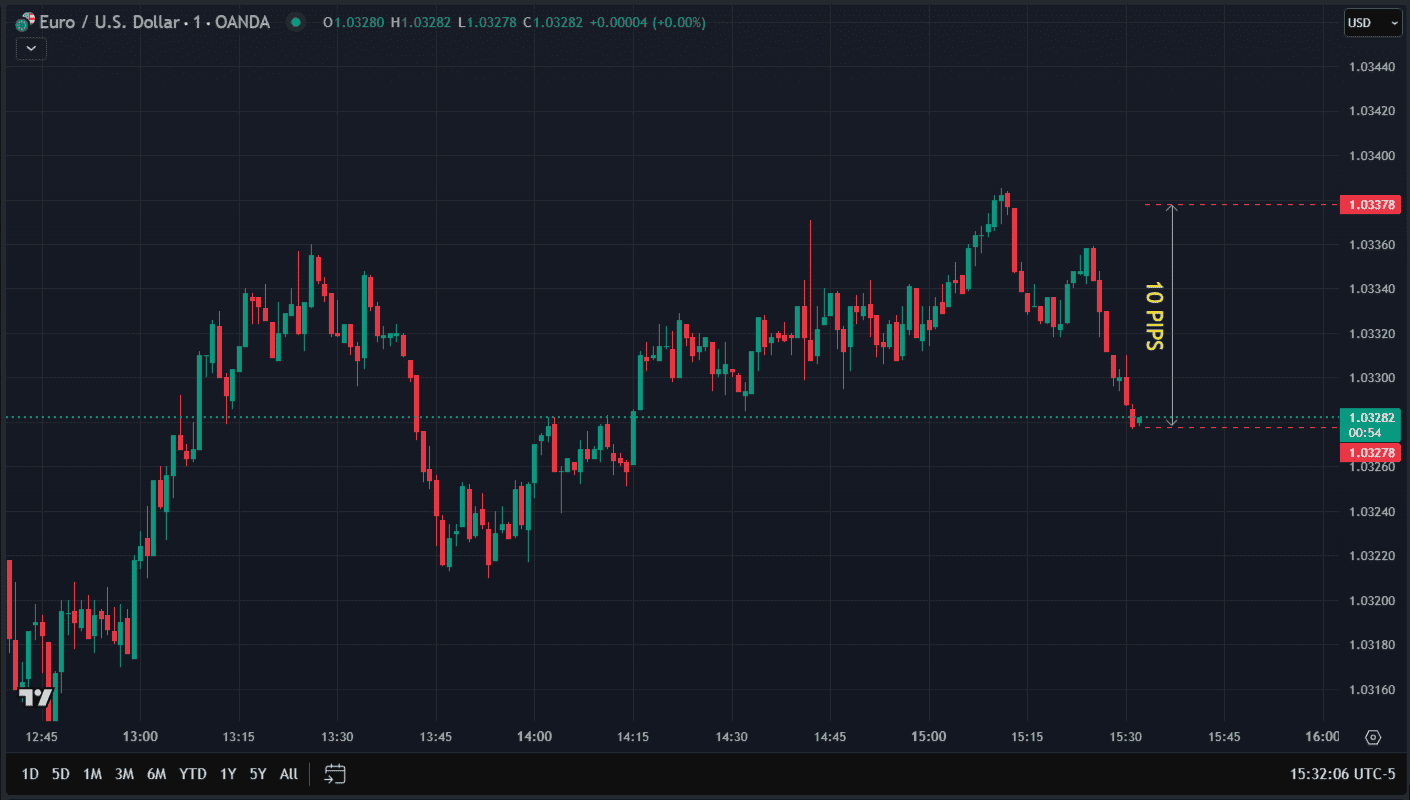

📏 What Is a Pip?

A pip (percentage in point) is the smallest price movement in a currency pair. It’s most commonly measured as a 0.0001 price change.

🔍 How to Calculate Pips

- For most pairs: 1 pip = 0.0001

- For JPY pairs: 1 pip = 0.01

📊 Example Calculations:

- EUR/USD moves from 1.1234 to 1.1244 = 10 pips.

- USD/JPY moves from 110.10 to 110.60 = 50 pips.

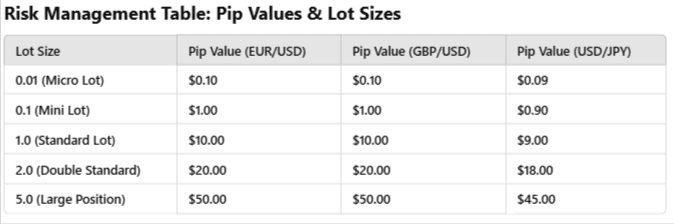

💹 How Pip Value Is Calculated

The pip value depends on the lot size and the currency pair being traded.

✅ Standard Pip Values for a 1.0 Lot (100,000 units):

- EUR/USD = $10 per pip

- USD/JPY = ¥1,000 per pip

- GBP/USD = $10 per pip

📐 Formula to Calculate Pip Value:

Pip Value = (Pip in Decimal Places × Trade Size) / Exchange Rate

🧮 Step-by-Step Calculation:

- 🔍 Identify the Standard Lot Size (e.g., 100,000 units).

- 💰 Define the Pip Size (e.g., 0.0001 for EUR/USD).

- 💱 Use the Exchange Rate of the currency pair.

- 📊 Apply the formula for pip value calculation.

📊 Example Calculation:

- For EUR/USD at 1.1234: (0.0001 × 100,000) / 1.1234 ≈ $8.90

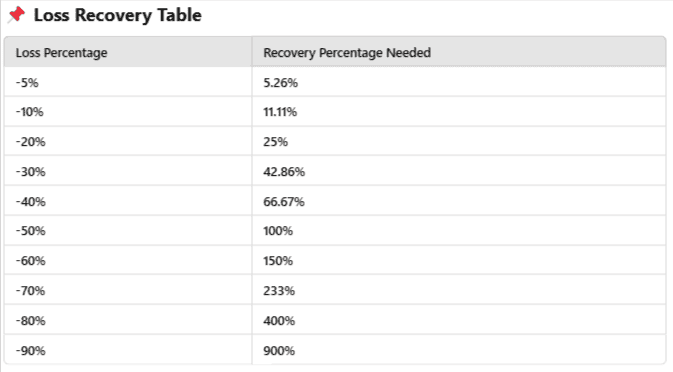

📊 How Pip Calculations Impact Trading Decisions

💡 1. Determining Profit/Loss

Example: Calculating risk with a stop-loss.

- Trade size: 1 standard lot

- Risk per trade: 50 pips

- Pip value: $10

- Total risk = 50 pips × $10 = $500

✅ 2. Setting Stop-Loss & Take-Profit

Use pip calculations to define stop-loss and take-profit points accurately.

📈 3. Position Sizing

- Apply pip values to determine proper lot sizes and manage risk efficiently.

🎯 Conclusion

Understanding currency pairs and pip calculations is fundamental for any forex trader. Mastering these concepts will help you make smarter trading decisions, set appropriate risk limits, and strengthen your overall strategy.

📘 Next Post:

Are you ready to sharpen your trading skills with expert pip calculation strategies? 🚀