? Updated: 05/02/2025

? By Elliott Wave Insights

The Principles Behind Elliott Waves Explained

📖 Introduction

Ever wondered why markets move in cycles? 🔄

Elliott Wave Theory provides a framework to understand market structure based on investor psychology, trends, and corrections. This guide explains the five-wave impulse pattern and the three-wave corrective structure, helping you apply these principles for better trading decisions.

✔️ By the end of this guide, you’ll learn:

- 📈 How Elliott Waves explain price movements

- 🌊 The 5-wave & 3-wave structures

- 🎯 How to apply Elliott Wave Theory in trading strategies

🌊 What is Elliott Wave Theory?

At its core, Elliott Wave Theory is a technical analysis method used to identify recurring market cycles and predict market trends.

🧠 Developed by Ralph Nelson Elliott in the 1930s, this theory suggests that market trends repeat due to investor sentiment, optimism, and fear.

Price movements follow two distinct wave types:

- 📈 Impulse Waves: Trending moves

- 🔄 Corrective Waves: Counter-trend moves

🔍 The Core Principles of Elliott Waves

Elliott discovered that markets don’t move randomly but follow structured wave cycles.

Each market cycle consists of:

- 📈 A five-wave impulse move (trending phase)

- 🔄 A three-wave corrective move (counter-trend phase)

These phases repeat across different timeframes, from short-term intraday charts to long-term market trends.

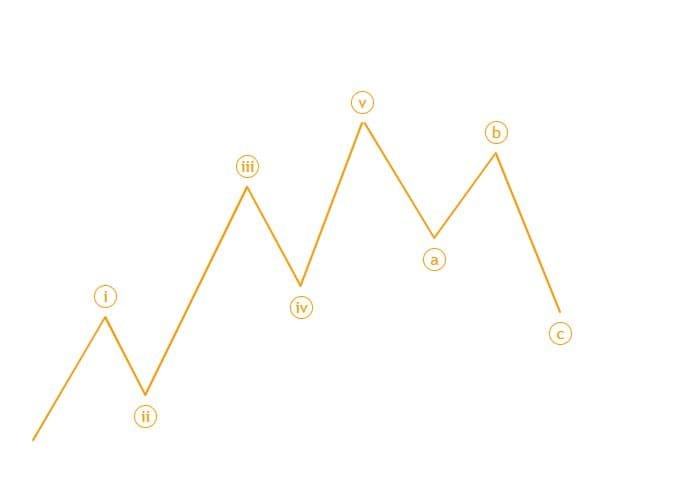

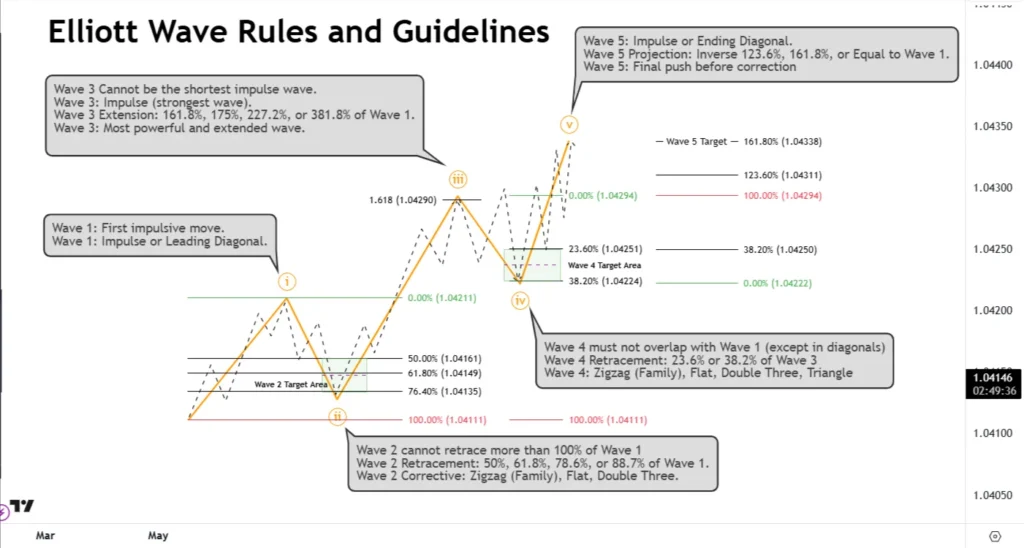

📊 The Five-Wave Impulse Pattern (1, 2, 3, 4, 5)

Impulse waves follow the market trend and consist of 5 waves:

- Wave 1: Initial move as early investors enter the trend.

- Wave 2: A pullback to test previous support levels.

- Wave 3: The longest and strongest wave as momentum strengthens.

- Wave 4: Consolidation phase before the final push.

- Wave 5: Final effort before a significant correction.

🔥 Pro Tip: Wave 3 is usually the longest and most profitable wave.

🔄 The Three-Wave Corrective Structure (A, B, C)

After an impulse, the market usually corrects with a three-wave pattern:

- Wave A: The first move against the prevailing trend.

- Wave B: Temporary retracement.

- Wave C: Final leg completing the correction.

These corrections often appear as:

- 🔺 Zigzag Patterns (5-3-5)

- 🔳 Flat Corrections (3-3-5)

- 🔻 Triangle Consolidations (A-B-C-D-E)

Zigzag (5-3-5)

🎯 How to Apply Elliott Wave Theory in Forex Trading

Applying Elliott Wave principles in trading can help:

- 📊 Predict market trends & reversals

- 💡 Identify high-probability entry & exit points

- 🎯 Improve risk management strategies

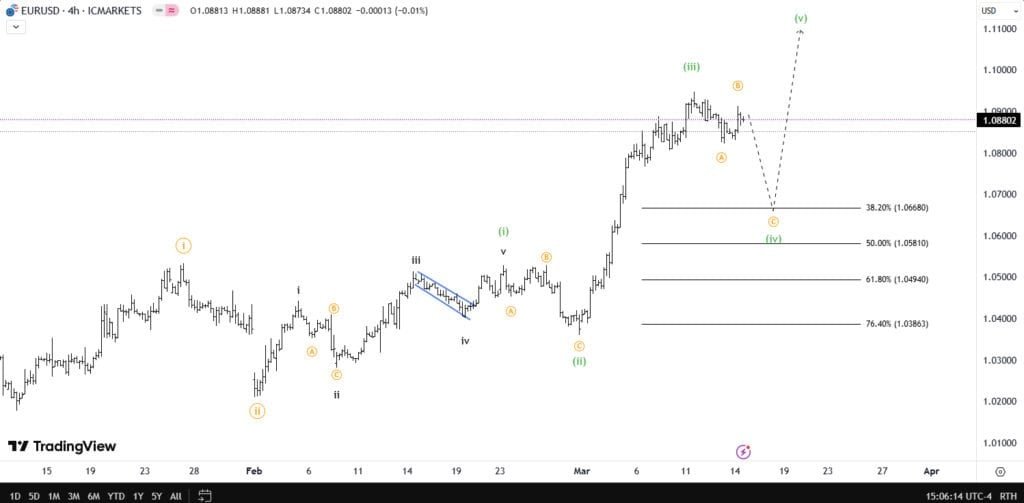

✅ 3 Steps to Using Elliott Waves in Trading

1️⃣ Identify Market Waves

- Use charting platforms like TradingView to label wave structures accurately.

2️⃣ Combine with Fibonacci Retracements

- 📉 Wave 2 typically retraces 50%, 61.8%, or 78.6% of Wave 1.

- 📈 Wave 3 often extends 161.8% of Wave 1.

3️⃣ Confirm with Indicators (RSI & MACD)

- Use momentum indicators to validate wave strength and reversals.

🚩 Common Elliott Wave Mistakes to Avoid

❌ Forcing wave counts – If the structure doesn’t fit, don’t force it.

❌ Ignoring Wave 3 rules – Wave 3 must not be the shortest impulse wave.

❌ Misidentifying corrective patterns – A flat vs. a zigzag can affect trade direction.

🏁 Final Thoughts & Next Steps

Elliott Wave Theory is a powerful tool for predicting market trends and understanding price cycles. Mastering these principles can refine your technical analysis and help you make smarter trading decisions.

🚀 Next Post:

📘 Mastering the Market: Core Elliott Wave Patterns You Need to Know

💬 Have questions? Leave a comment below!