The 2% Rule: Managing Risk in Forex Trading

Introduction

Risk management is crucial in forex trading. The 2% rule is a popular method to limit losses and preserve trading capital. This guide explores the rule’s benefits and provides practical steps to apply it effectively.

🔍 What Is the 2% Rule?

The 2% rule means risking no more than 2% of your total account balance on a single trade. This ensures that losing streaks don’t quickly wipe out your account.

Example Calculation:

- If your account balance is $10,000, the maximum risk per trade would be $200 (2%).

- For a trade requiring a 50-pip stop-loss, adjust your lot size so the total risk equals $200.

Here’s your clear, easy-to-follow table illustrating a $50,000 trading account with a 2% risk per trade, including position sizing examples for Gold, Crude Oil, Natural Gas, S&P 500, Nasdaq, EUR/USD, and Bitcoin.

Assumptions:

- All trades risk 2% of a $50,000 account (=$1,000 per trade).

- Lot sizes calculated based on typical contract specifications and standard pip/tick values.

| Asset | Account Size ($) | Risk (%) | Risk Amount ($) | Stop Loss | Lot Size |

|---|---|---|---|---|---|

| Gold (XAU/USD) | 50,000 | 2% | 1,000 | 50 pips | 2 lots |

| Crude Oil (WTI) | 50,000 | 2% | 1,000 | 100 ticks | 1 lot |

| Natural Gas (NG) | 50,000 | 2% | 1,000 | 200 ticks | 0.5 lots |

| S&P 500 (ES) | 50,000 | 2% | 1,000 | 20 points | 1 contract |

| Nasdaq (NQ) | 50,000 | 2% | 1,000 | 40 points | 0.5 contracts |

| EUR/USD (Forex) | 50,000 | 2% | 1,000 | 50 pips | 2 standard lots |

| Bitcoin (BTC/USD) | 50,000 | 2% | 1,000 | 500 points | 0.02 lots (approx.) |

Explanations & Calculations (briefly explained):

- Gold (XAU/USD):

Standard lot pip value: ~$10/pip

Calculation: $1,000 ÷ 50 pips ÷ $10 per pip = 2 lots - Crude Oil (WTI):

Standard contract tick value: $10/tick

Calculation: $1,000 ÷ 100 ticks ÷ $10 per tick = 1 lot - Natural Gas (NG):

Standard contract tick value: $10/tick

Calculation: $1,000 ÷ 200 ticks ÷ $10 per tick = 0.5 lots - S&P 500 (ES):

Standard E-mini S&P tick value: $12.50 per tick (4 ticks = 1 point, thus $50 per point)

Calculation: $1,000 ÷ 20 points ÷ $50 per point = 1 contract - Nasdaq (NQ):

Standard E-mini Nasdaq tick value: $5 per tick (4 ticks = 1 point, thus $20 per point)

Calculation: $1,000 ÷ 40 points ÷ $20 per point = 1.25 ≈ rounded to 1 or 0.5 contracts for conservative sizing - EUR/USD (Forex):

Standard lot pip value: $10/pip

Calculation: $1,000 ÷ 50 pips ÷ $10 per pip = 2 lots - Bitcoin (BTC/USD):

Typical lot size 1 BTC = $1 per point

Calculation: $1,000 ÷ 500 points ÷ $1 per point = 0.02 BTC

This provides a clear framework for setting lot sizes and risk management across diverse markets.

Here’s a clear breakdown of pips, points, and ticks, highlighting their differences and their typical use across various financial markets:

📌 Pip (Percentage in Point)

A pip is the smallest standardized price increment used primarily in forex markets. It typically represents the fourth decimal place in most currency pairs, except for pairs involving JPY, where a pip represents the second decimal place.

- Examples:

- EUR/USD from 1.1050 → 1.1051 (change = 1 pip)

- USD/JPY from 110.20 → 110.21 (change = 1 pip)

Common Use: Forex (Currency Pairs)

📌 Point

A point refers to the smallest unit of price change on the left side of a decimal. It represents the most basic unit of price movement in many indices, stocks, commodities, or cryptocurrencies. It’s not standardized across markets, as each market sets its own scale.

- Examples:

- S&P 500 moves from 4,000 → 4,001 (change = 1 point)

- Gold (XAU/USD) moves from 2000.00 → 2001.00 (change = 1 point)

Common Use: Stock indices (e.g., Dow, S&P 500, NASDAQ), Commodities (Gold), Cryptocurrencies (Bitcoin)

📌 Tick

A tick represents the smallest possible increment or decrement at which the price of a particular market or instrument can trade. It varies significantly by market and instrument.

- Examples:

- Crude Oil (WTI) typically moves in increments of $0.01 per barrel (1 tick = $0.01).

- E-mini S&P 500 futures trade in 0.25 point increments (each increment = 1 tick).

- If S&P 500 futures move from 4000.00 → 4000.25, that’s 1 tick (but 0.25 points).

Common Use: Futures markets, Commodity markets

✅ Quick Summary Table

| Term | Markets | Represents | Example |

|---|---|---|---|

| Pip | Forex | Smallest increment in currency prices | EUR/USD 1.1050 → 1.1051 |

| Point | Stocks, Indices, Crypto, Commodities | Basic unit of price movement | Gold (XAU) $2000 → $2001, S&P 500: 4000 → 4001 |

| Tick | Futures, Commodities | Minimum increment instrument trades | E-mini S&P moves 4000.00 → 4000.25 |

🎯 Why These Differences Matter:

- Risk Management:

Precise position sizing depends on accurately calculating risk per pip, point, or tick. - Trading Costs:

Spreads or commissions often quoted in terms of these increments, so knowing their value helps manage costs. - Order Accuracy:

Correctly placing stop-loss and take-profit orders requires understanding the minimum increments for the specific market traded.

🚨 Why the 2% Rule Works

1. Prevents Large Drawdowns

- Reduces impact from multiple consecutive losing trades.

2. Encourages Consistency

- Keeps trading disciplined and prevents emotional decision-making.

3. Protects Trading Psychology

- Reduces emotional stress from large losses.

- Promotes long-term profitability rather than chasing quick wins.

📉 Image Suggestion: A graph comparing account equity curves with and without using the 2% rule.

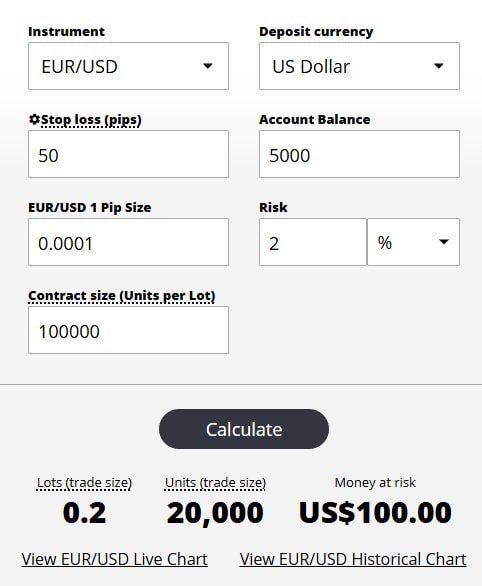

📌 How to Apply the 2% Rule in Your Trading

Step 1: Determine Your Account Balance

- Example: $5,000 trading account

- 2% risk per trade: $100 maximum per trade

Step 2: Calculate Position Size

- Define your stop-loss distance (in pips).

- Use the formula:

- Position Size = (Risk per Trade) / (Pip Value × Stop-Loss in Pips)

Example:

- Risk = $100

- Stop-loss = 50 pips

- Pip Value = $1 per pip (for 1 mini lot)

Position Size: 100 ÷ (50 × 1) = 2 mini lots

✅ Check your calculations!

Risk Calculator

❌ Common Mistakes to Avoid

- Ignoring Risk-Reward Ratios: Always aim for at least a 1:2 ratio.

- Overleveraging: Even with the 2% rule, excessive leverage can amplify losses.

- Adjusting Risk per Trade: Consistency is key—avoid altering your risk based on emotions.

🎯 Conclusion

The 2% rule is a powerful tool in managing trading risk. Incorporate it into your trading strategy to enhance discipline, protect your capital, and achieve consistent results.

🚀 Next Steps:

✅ Learn more about Position Sizing Strategies Introduction