📖 Introduction

One of the key components of successful forex trading is risk management. Knowing how to use stop-loss and take-profit orders effectively can protect your capital and lock in gains. This guide will cover various stop-loss and take-profit strategies to help you trade smarter.

❓ What Are Stop-Loss & Take-Profit Orders?

🔒 Stop-Loss Order: A predetermined price level at which a losing trade is closed automatically to limit losses.

💰 Take-Profit Order: A target price level where a trade is automatically closed to secure profits.

💡 Why Stop-Loss & Take-Profit Are Essential

✅ Protects Capital: Prevents excessive losses from unexpected market movements.

✅ Removes Emotions: Encourages disciplined trading by sticking to predefined exit points.

✅ Maximizes Profits: Helps lock in gains without second-guessing.

🔍 Types of Stop-Loss Strategies

📌 1. Fixed Stop-Loss

- Set price level, such as 30 pips away from entry.

- Best for new traders and low-volatility pairs.

📈 2. Trailing Stop-Loss

- Moves in favor of the trade, securing more profits while reducing risk.

- Best for trending markets.

📊 3. ATR-Based Stop-Loss

- Uses the Average True Range (ATR) to set stop-loss levels based on market volatility.

- Best for volatile currency pairs.

🎯 Take-Profit Strategies

✅ 1. Fixed Take-Profit

- Predetermined exit point based on a risk-reward ratio (e.g., 2:1).

- Simple and effective for consistent profits.

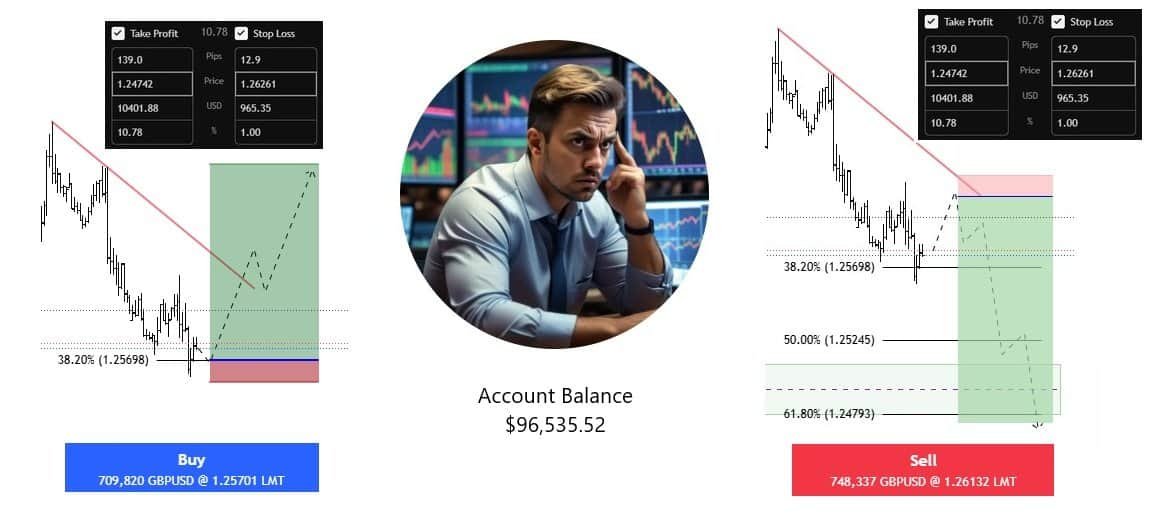

🔢 2. Fibonacci-Based Take-Profit

- Uses Fibonacci retracement levels to determine take-profit targets.

- Best for trend-based trading.

📉 3. Partial Profit Taking

- Closing part of a position at a specific profit level and letting the rest run.

- Helps lock in profits while allowing for further gains.

🛠️ How to Set Stop-Loss & Take-Profit Correctly

✅ Step-by-Step Process:

- 🎯 Identify Entry Point: Choose your trade setup.

- 📈 Determine Risk Per Trade: Stick to the 2% rule.

- 📊 Select Stop-Loss Method: Fixed, trailing, or ATR-based.

- 💰 Set Take-Profit Target: Aim for a minimum 2:1 risk-reward ratio.

❌ Common Mistakes to Avoid

🚫 Setting Stop-Loss Too Tight: Increases chances of being stopped out early.

🚫 Ignoring Market Volatility: Not adjusting SL/TP based on currency pair behaviour.

🚫 Over-Reliance on Fixed Levels: Failing to adapt stop-loss to changing market conditions.

🏁 Conclusion

Using stop-loss and take-profit orders effectively can drastically improve your forex trading results. By choosing the right strategy, you can protect capital, remove emotions, and maximize profits.

📘 Next Post:

Are you ready to take your trading strategy to the next level? 🚀