📖 Introduction

Understanding different forex order types is essential for executing trades efficiently and managing risk. This guide explores market orders, limit orders, and stop orders, providing examples and best-use scenarios to enhance your trading decisions.

💹 Market Orders

A market order is an instruction to buy or sell a currency immediately at the current market price.

📌 Key Features:

✔ Executed instantly at the best available price.

✔ No price guarantee—subject to market fluctuations.

✔ Best for traders who prioritize speed over price precision.

📊 Example:

If EUR/USD is trading at 1.1298/1.1302, placing a market buy order executes at 1.1302, the ask price.

✅ Best Use Cases:

- Highly liquid forex pairs with deep order books.

- Entering a trade quickly when price movement is favorable.

- Exiting positions immediately to lock in profits or minimize losses.

📌 Limit Orders

A limit order allows traders to buy at a lower price or sell at a higher price than the current market level.

📌 Types of Limit Orders:

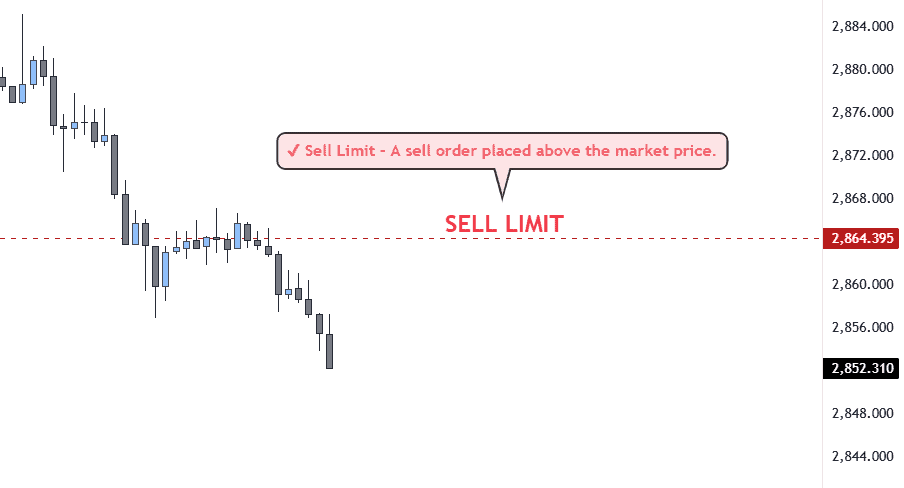

✔ Buy Limit – A buy order placed below the market price.

✔ Sell Limit – A sell order placed above the market price.

📊 Example:

If EUR/USD is trading at 1.1300, placing a buy limit order at 1.1280 ensures that you only buy if the price drops to 1.1280.

✅ Best Use Cases:

- Entering trades at optimal price levels for better risk/reward ratios.

- Avoiding slippage by waiting for a precise entry point.

- Implementing strategic swing trading and support/resistance strategies.

📌 Stop Orders

A stop order is an order type that activates a buy or sell only when a certain price is reached.

📌 Types of Stop Orders:

✔ Buy Stop – A buy order placed above the current market price.

✔ Sell Stop – A sell order placed below the current market price.

📊 Example:

If EUR/USD is trading at 1.1300, placing a buy stop at 1.1320 means the trade will only execute if the price moves up to 1.1320.

✅ Best Use Cases:

- Catching breakout trades when price moves past key levels.

- Managing risk with stop-loss orders to limit downside exposure.

📌 Stop-Loss & Take-Profit Orders

These risk management tools automatically execute trades to lock in profits or limit losses.

📌 Example:

- A trader buys EUR/USD at 1.1300 and places: ✔ Stop-loss at 1.1280 (to cap losses).

✔ Take-profit at 1.1350 (to secure gains).

📌 Choosing the Right Forex Order Type

| Order Type | Best For | Executed Instantly? | Guarantees Price? |

|---|---|---|---|

| Market Order | Immediate entry/exits | ✅ Yes | ❌ No |

| Limit Order | Entering at a better price | ❌ No | ✅ Yes |

| Stop Order | Breakout trading | ❌ No | ✅ Yes |

📌 Conclusion

Choosing the right forex order type improves trading efficiency, reduces slippage, and helps execute strategic trade entries and exits. Mastering market, limit, and stop orders is essential for optimizing trade performance.

📘 Next Post: