🔍 Introduction

Elliott Wave Theory is a cornerstone of technical analysis, offering insights into market psychology and future price movements through identifiable patterns. Understanding these patterns is crucial for traders aiming to capitalize on the forex market’s natural rhythms.

In this guide, you’ll learn about:

- 📈 Impulse Waves – Driving the market trends.

- 🔄 Corrective Waves – Countering trends and creating retracements.

- 🎯 How to apply wave patterns effectively in trading.

🌊 The Core Elliott Wave Patterns

📈 Impulse Waves

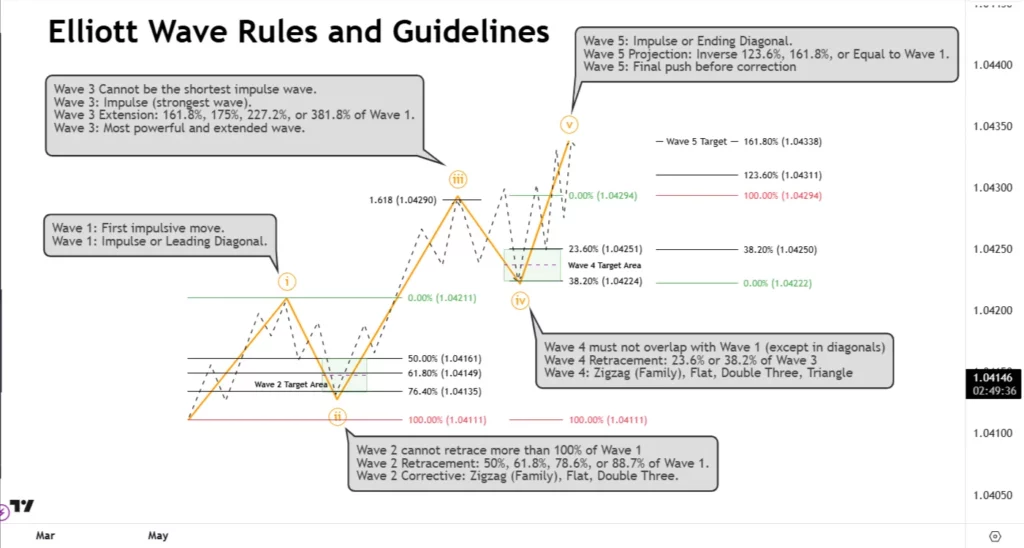

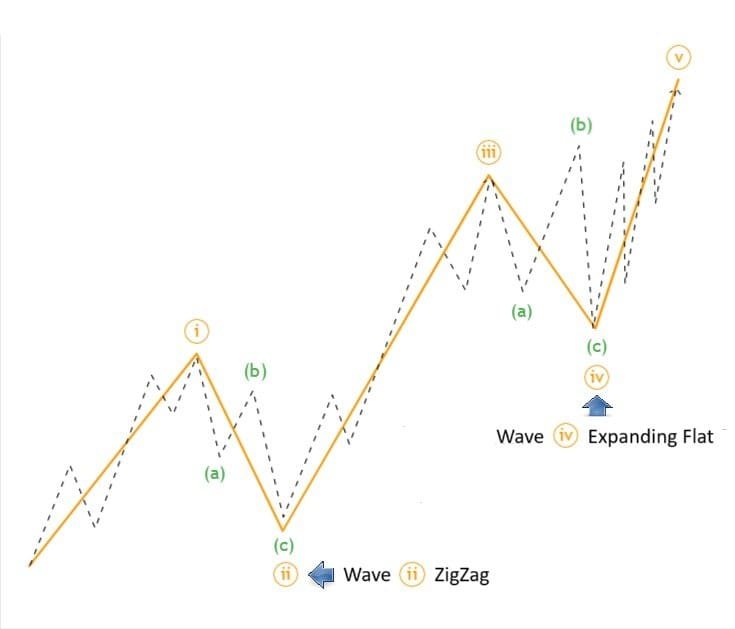

Impulse waves are fundamental to the Elliott Wave approach, propelling the market in the direction of the prevailing trend. Typically, an impulse wave consists of five smaller waves (1, 2, 3, 4, 5):

- 🔍 Characteristics: Strong directional movement, especially in the third wave, which is typically the longest and most powerful.

- 📊 Identification: Look for a wave making a new high or low supported by increased volume.

- 🎯 Trading Strategy: Enter trades at the start of the impulse wave and consider exiting before it completes to maximize gains.

📊 Image Suggestion: Diagram showcasing a 5-wave impulse pattern with market entries.

🔄 Corrective Waves

Corrective waves serve to counter the preceding impulse moves and typically unfold in patterns distinct from the impulse sequence:

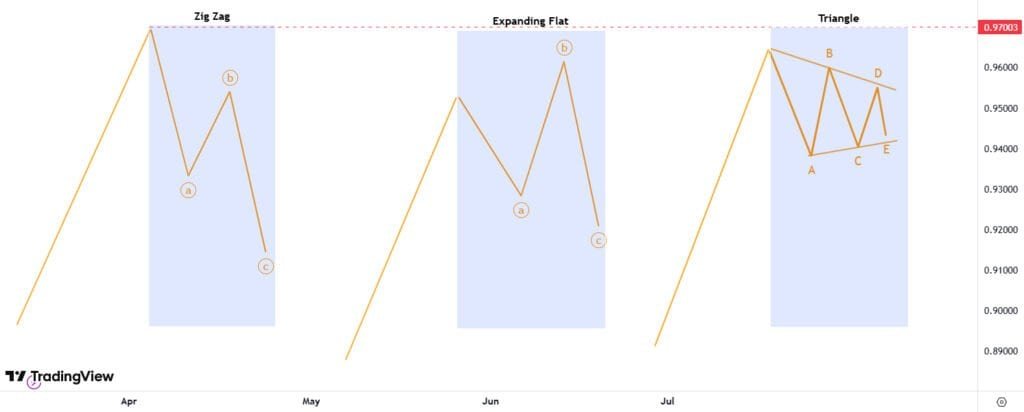

🔺 Zigzag Corrections

- 🔍 Structure: A sharp three-wave movement labeled A-B-C.

- 📊 Identification: Look for sharp reversals against the prevailing trend.

- 🎯 Trading Strategy: Capitalize on entry opportunities at the start of waves A or C.

🔳 Flat Corrections

- 🔍 Structure: Three-wave patterns (A-B-C), with Wave B often retracing 100% of Wave A.

- 📊 Identification: Look for sideways movement that confuses market direction.

- 🎯 Trading Strategy: Use careful stop-losses since C waves can extend unexpectedly.

🔻 Triangular Corrections

- 🔍 Structure: Complex five-wave corrections (A-B-C-D-E).

- 📊 Identification: Look for converging or diverging trendlines.

- 🎯 Trading Strategy: Trade breakouts after the E wave, typically signaling trend continuation.

📊 Image Suggestion: Chart comparing zigzag, flat, and triangular corrections.

🎯 Applying Elliott Wave Patterns in Forex Trading

Combining Elliott Wave recognition with technical indicators like Fibonacci retracements, RSI, and MACD enhances your analysis. For example, confirming an impulse setup with a Fibonacci extension adds confidence to the trade.

✅ 3 Steps to Using Elliott Wave Patterns in Trading

1️⃣ Identify Market Waves

- Use charting platforms like TradingView to mark wave structures.

2️⃣ Combine with Fibonacci Retracements

- Wave 2 retracement: 50%, 61.8%, 78.6% of Wave 1.

- Wave 3 extension: 161.8%, 261.8%, or 423.6% of Wave 1.

3️⃣ Confirm with RSI and MACD

- Use momentum indicators to confirm potential reversals and strength.

📚 Resource Suggestion: Guide on integrating Fibonacci tools with Elliott Wave Theory.

🚩 Common Elliott Wave Mistakes to Avoid

❌ Forcing wave counts – If it doesn’t fit, don’t force it.

❌ Ignoring Wave 3 rule – Wave 3 must not be the shortest impulse wave.

❌ Misidentifying corrective patterns – Be aware of market structure shifts that can invalidate patterns.

❓ Frequently Asked Questions (FAQs)

Q: What is the best Elliott Wave indicator?

- A combination of Elliott Wave labels, Fibonacci retracements, and RSI/MACD works best.

Q: How do I practice Elliott Wave analysis?

- Analyze historical charts or practice using live demo accounts to gain market insights.

🏁 Conclusion

Understanding core Elliott Wave patterns is essential for recognizing market structures and predicting future price movements. By mastering both impulse and corrective waves, traders gain valuable insights that can elevate trading success.

🚀 Next Post:

💬 Have any questions? Leave a comment below!