Impulse waves are the core engine of trending markets. In this lesson, you’ll learn how to spot, label, and trade them confidently.

🔹 What is an Impulse Wave?

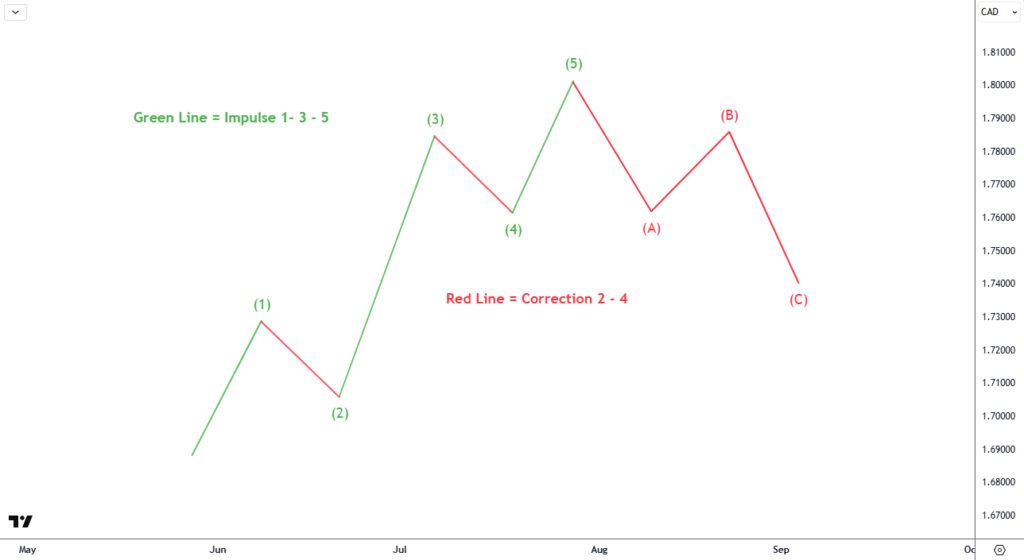

An impulse wave is a strong, directional price movement made up of five sub-waves: three motive waves (1, 3, 5) in the direction of the trend and two corrective waves (2, 4) against it. It’s the most common structure for trending moves in Elliott Wave Theory.

Impulse waves drive the market in the direction of the larger trend, and they often appear in waves 1, 3, or 5 of a full 5-wave cycle, or in wave A or C of a correction.

🔹 Structure Breakdown: 5-Wave Sequence

- Wave 1: Initial move in the trend direction.

- Wave 2: First pullback, often deep but doesn’t retrace all of wave 1.

- Wave 3: The strongest, longest, and most explosive wave (often extended).

- Wave 4: A shallower correction, typically side ways.

- Wave 5: Final push before a larger correction or reversal.

🔹 Impulse Wave Rules (Must Follow)

- Wave 2 cannot retrace more than 100% of wave 1.

- Wave 3 cannot be the shortest of waves 1, 3, and 5.(Wave 3 cannot be a Diagonal)

- Wave 4 must not overlap wave 1 in price (except in leading diagonals).

🔹 Common Guidelines (Typical Behaviours)

- Wave 3 is usually the longest and most powerful.

- Wave 2 often retraces to the 61.8% or 78.6% Fibonacci level.

- Wave 4 often retraces to the 38.2% level and may form a triangle or flat.

- Alternation: If wave 2 is sharp, wave 4 is usually sideways, and vice versa.

❌ Common Mistakes: When an Impulse Isn’t Valid

“If Wave 3 is the shortest, the structure is invalid — this might actually be a diagonal or corrective wave.”

📌 Advanced Note: Truncations & Extensions

While most impulse waves follow a clean 5-wave rhythm, there are two important variations worth knowing:

- Extended Waves:

One of the motive waves (usually Wave 3) can stretch dramatically and subdivide into smaller 5-wave structures. Example: Wave 3 often extends to 161.8%, 261.8%, or even 423.6% of Wave 1. - Truncated Wave 5:

Sometimes Wave 5 fails to exceed the high (or low) of Wave 3 — this is called a truncation. It often signals a weakening trend or upcoming reversal. Tip: Truncations can occur when Wave 3 is unusually strong and exhaustive.

🌀 Wave-by-Wave Breakdown: Personalities & Behavior

Understanding the personality of each wave helps in anticipating market flow:

🔹 Wave 1

- Starts the trend — often overlooked or confused as part of a correction

- Usually forms after a major low or high

- Low volume and little news attention

🔹 Wave 2

- Sharp retracement of Wave 1 (often 61.8%–78.6%)

- Sentiment still bearish (in uptrend), causing traders to doubt the reversal

- Often ends at Fib support or trendline

🔹 Wave 3

- Strongest and longest wave in most cases

- Backed by fundamentals, volume surge, and trend momentum

- Traders start piling in — often extended beyond 161.8% of Wave 1

🔹 Wave 4

- Consolidation phase — triangle, flat, or sideways

- Typically retraces only 23.6%–38.2% of Wave 3

- Alternates in complexity with Wave 2 (e.g., if Wave 2 was sharp, Wave 4 is often flat)

🔹 Wave 5

- Final move in the direction of the trend

- Often driven by retail traders chasing the trend

- May form divergence on RSI or MACD

- Can truncate or form a blow-off top/bottom

🔍 Here’s a simplified diagram showing a typical 5-wave impulse — motive waves in green, corrective in red.

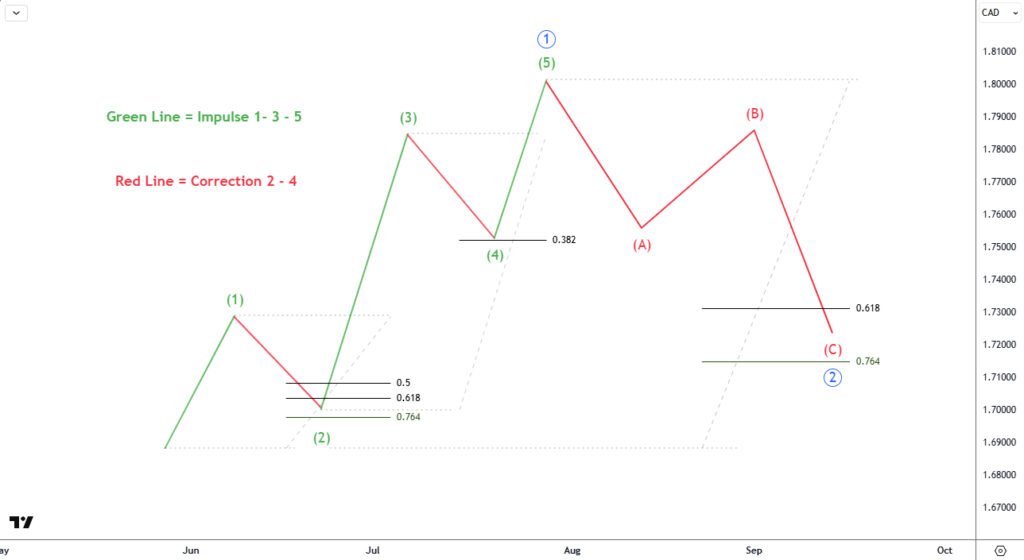

🔹 How to Trade Impulse Waves (Example: Wave 2 Entry)

A common way to trade impulse waves is by entering at the start of wave 3, once waves 1 and 2 have formed.

📈 In the example above:

- Aggressive Entry: In the 0.5–0.618 Fibonacci retracement zone of wave 2, or on a trendline break.

- Conservative Entry: After price breaks above the high of wave 1.

- Stop-loss Options:

- Aggressive: Just below the wave 2 low

- Conservative: Below the prior wave (4)

- Target: 161.8% extension of wave 1 — a typical projection for wave 3.

- Confirmation Tools: Look for structure breaks, RSI divergence, or volume surges near the entry zone.

📈 EURUSD Impulse Wave

EURUSD chart showing bullish impulse wave with labels 1–5 and notes on fib levels, divergence, and volume spikes.)

🧠 Key Takeaways:

- An impulse wave has 5 sub-waves: 3 motive, 2 corrective

- Wave 3 is usually the strongest — and a prime entry point

- Confirm your trades with structure, RSI, or Fib levels

- Conservative entries reduce risk, but aggressive ones offer more reward

Later in the course, we’ll explore diagonals, wave extensions, and how to avoid false breakouts.

Ready to level up? → Go to Lesson 2: Corrective Waves