📘 Introduction

The forex market operates 24 hours a day, five days a week, with trading activity shifting across different global sessions. Understanding these trading sessions and their impact on liquidity and volatility is essential for traders looking to optimize their strategies and trade during the most profitable market conditions.

📊 How Forex Liquidity Changes Across Trading Sessions

Each trading session has unique characteristics based on:

- Market participants

- Liquidity levels

- Volatility patterns

By identifying when the market is most active, traders can align their strategies to maximize their profit potential.

🌍 The 4 Major Forex Market Sessions (With Trading Strategies)

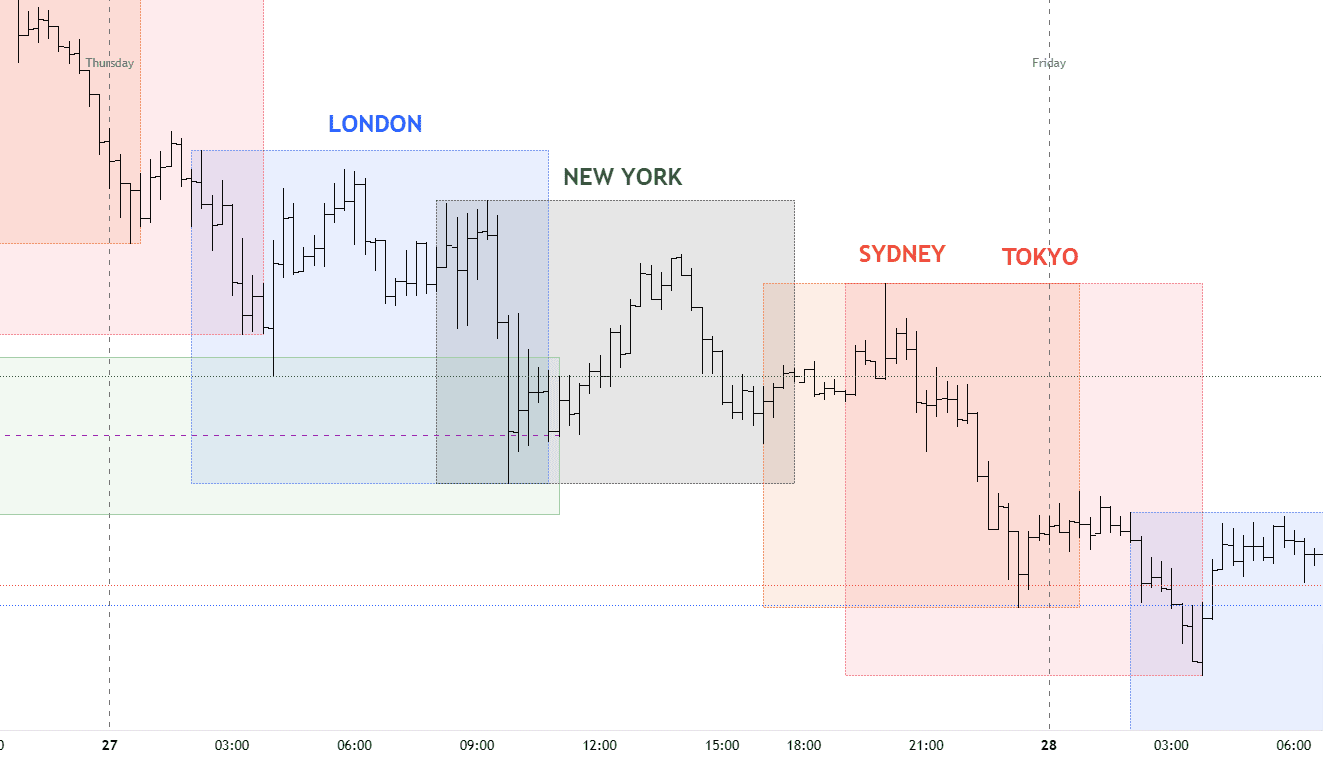

Unlike stock markets, the forex market does not have a central exchange. Instead, it operates through major financial centers worldwide. The forex trading day is divided into four main sessions:

🌙 1. Sydney Session (10 PM – 7 AM UTC)

- 🔒 Best for range-bound trading with low volatility

- 💱 Major currency pairs: AUD/USD, NZD/USD

- 📈 Trading strategy: Focus on support & resistance levels

🌅 2. Tokyo Session (12 AM – 9 AM UTC)

- 💡 Known for low volatility, best for yen pairs (USD/JPY, EUR/JPY)

- 📊 Best time to trade yen-related currencies

- 🔄 Trading strategy: Use breakout strategies during overlap with Sydney

💷 3. London Session (7 AM – 4 PM UTC)

- 🔥 Most liquid session with high volatility

- 💱 Major currency pairs: EUR/USD, GBP/USD

- 📈 Trading strategy: Focus on breakout and trend-following strategies

🗽 4. New York Session (12 PM – 9 PM UTC)

- 🔄 Overlaps with London, creating the most volatile market hours

- 💱 Major currency pairs: EUR/USD, USD/JPY, GBP/USD

- 🔧 Trading strategy: Use momentum trading & trend continuation setups

🏆 Best Time to Trade Forex for Maximum Liquidity & Profits

The London–New York Overlap (12 PM – 4 PM UTC) is typically the best time to trade due to:

✅ Highest liquidity and price movement

✅ Fewer random gaps during high liquidity periods

✅ Economic news releases often occur during this time, creating sharp price movements

⚠️ Avoid trading during session gaps, as low liquidity can lead to unpredictable price swings.

💡 How to Use Forex Market Sessions to Your Advantage

✔️ Plan your strategy around session overlaps for maximum liquidity

✔️ Identify currency pairs that perform best in each session

✔️ Adapt to session characteristics—avoid trading during low-volatility periods

🔥 Final Thoughts

Understanding forex market sessions is essential for traders aiming to capitalize on liquidity and volatility. By aligning trading strategies with the most active market hours, you can significantly increase your chances of success.

📘 Next Post:

Would you like to dive deeper into advanced trading strategies? 🚀