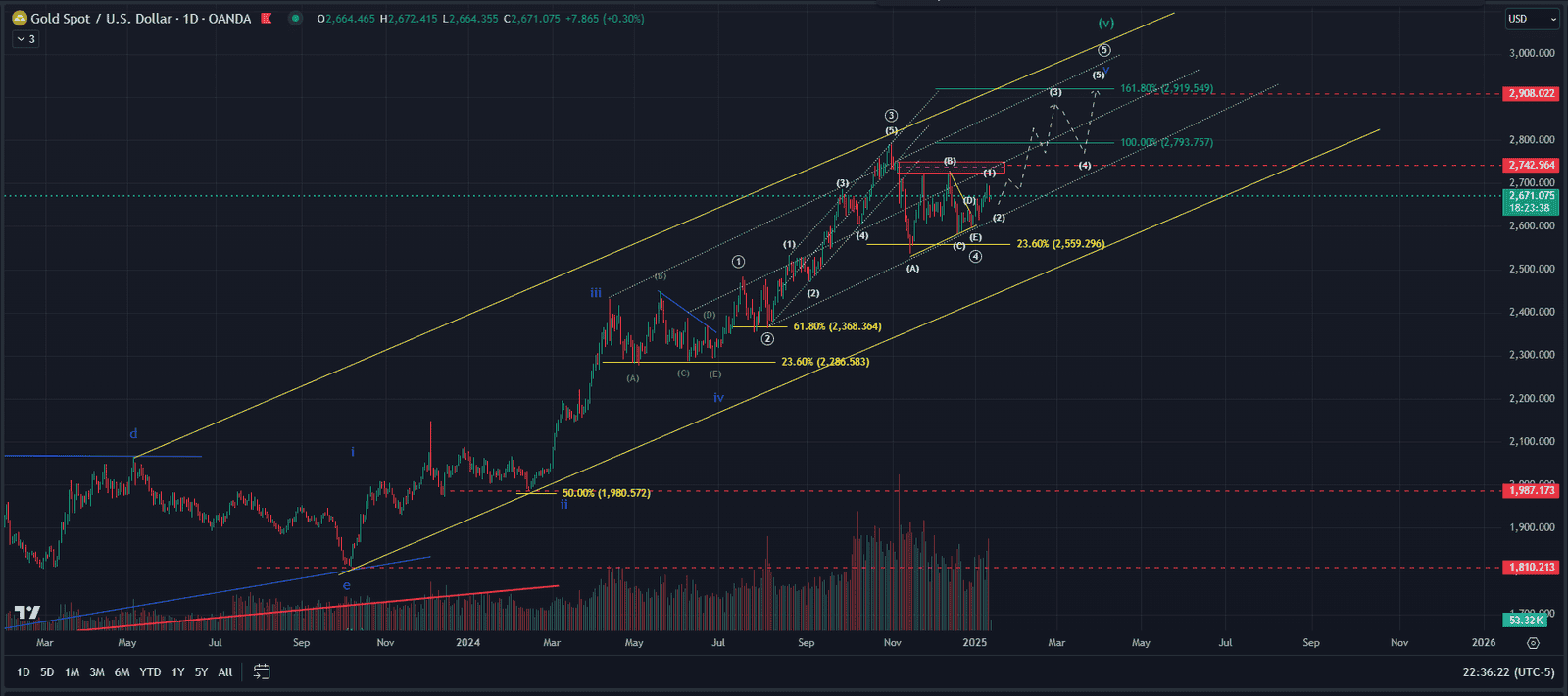

? Gold Hits $2,887 – What’s Next?

Gold has reached our projected resistance zone of $2,874 – $2,940, perfectly aligning with our Elliott Wave analysis. Now, the key question is:

? Will XAU/USD break past $2,940 toward $3,050?

? Or is a correction back to $2,740 in play?

? Key Price Levels to Watch

✅ Bullish Targets:

- $2,874 – $2,940 (Previously projected resistance)

- $3,000 – $3,050 (Next upside Fibonacci extension)

✅ Bearish Scenario:

- If $2,940 rejects price action, a correction could unfold.

- Support Levels:

- $2,740 (Previous breakout zone)

- $2,634 – $2,500 (Deeper correction levels)

? Elliott Wave Breakdown: How We Got Here

- In our last analysis, we anticipated that Gold was in Wave (5) of an impulse.

- The latest price action confirms this bullish cycle, with Gold hitting $2,887, near the 161.8% Fibonacci extension of $2,905.

- RSI & MACD still show strength, but a slowdown at this level could signal a pending correction.

? Trading Strategy Considerations

? Bearish Approach (Shorting Gold)

- Look for a confirmed rejection at $2,940.

- A breakdown below $2,861 could signal weakness.

- Target $2,740, with an extended target at $2,500.

? Bullish Approach (Buying Gold)

- If $2,905 – $2,940 holds as support, the uptrend remains intact.

- A clean breakout above $2,940 could push toward $3,050.

- Watch for consolidation above $2,861 as a confirmation.

? What’s Your Take? Drop a Comment Below!

Do you think Gold will break past $3,000, or is a correction due?

? Comment your predictions! ?

? Follow for More:

✅ Weekly Elliott Wave Reports

✅ Premium Trading Setups

✅ Market Updates on Forex, Gold & Crypto