The 2% Rule: Managing Risk in Forex Trading

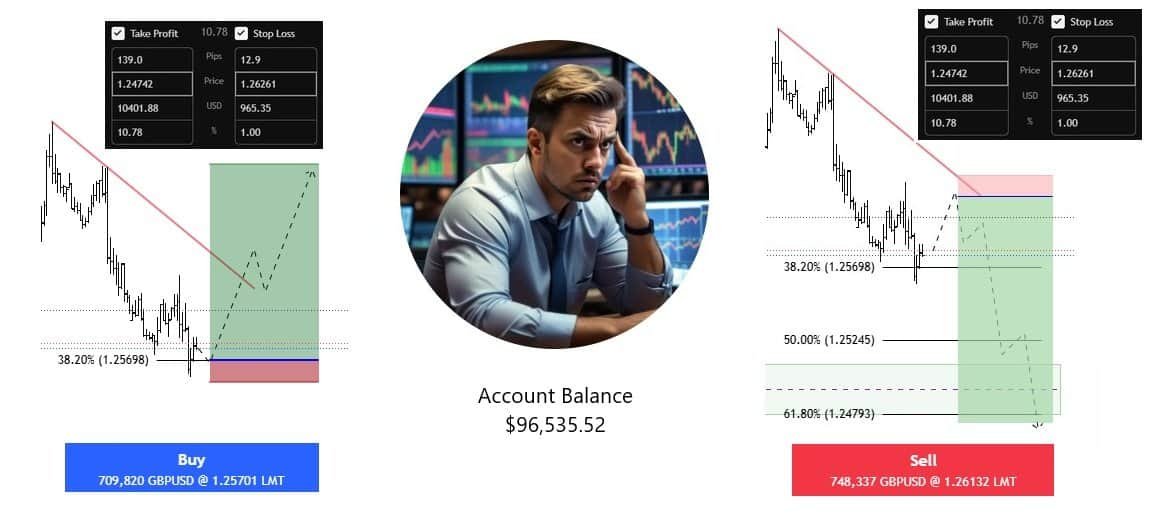

The 2% Rule: Managing Risk in Forex Trading Introduction Risk management is crucial in forex trading. The 2% rule is a popular method to limit losses and preserve trading capital. This guide explores the rule’s benefits and provides practical steps to apply it effectively. 🔍 What Is the 2% Rule? The 2% rule means risking … Read more