Change in State of Delivery (CISD) – Complete Smart-Money Guide

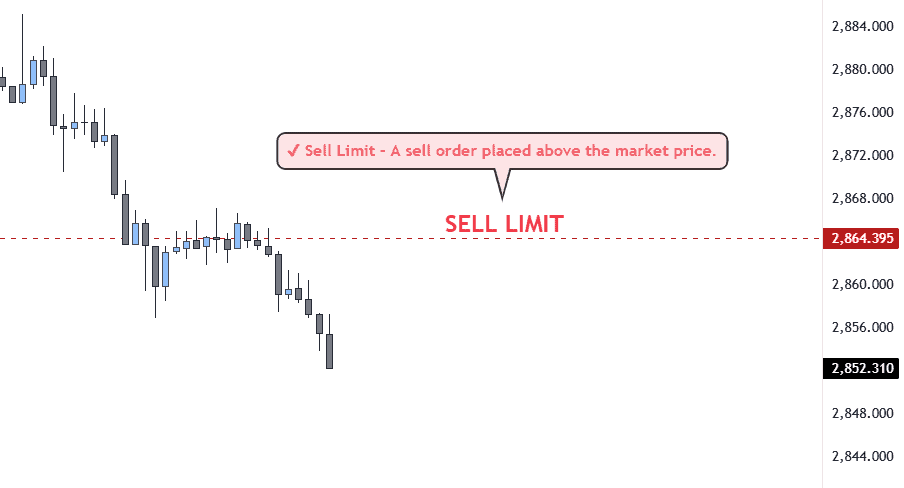

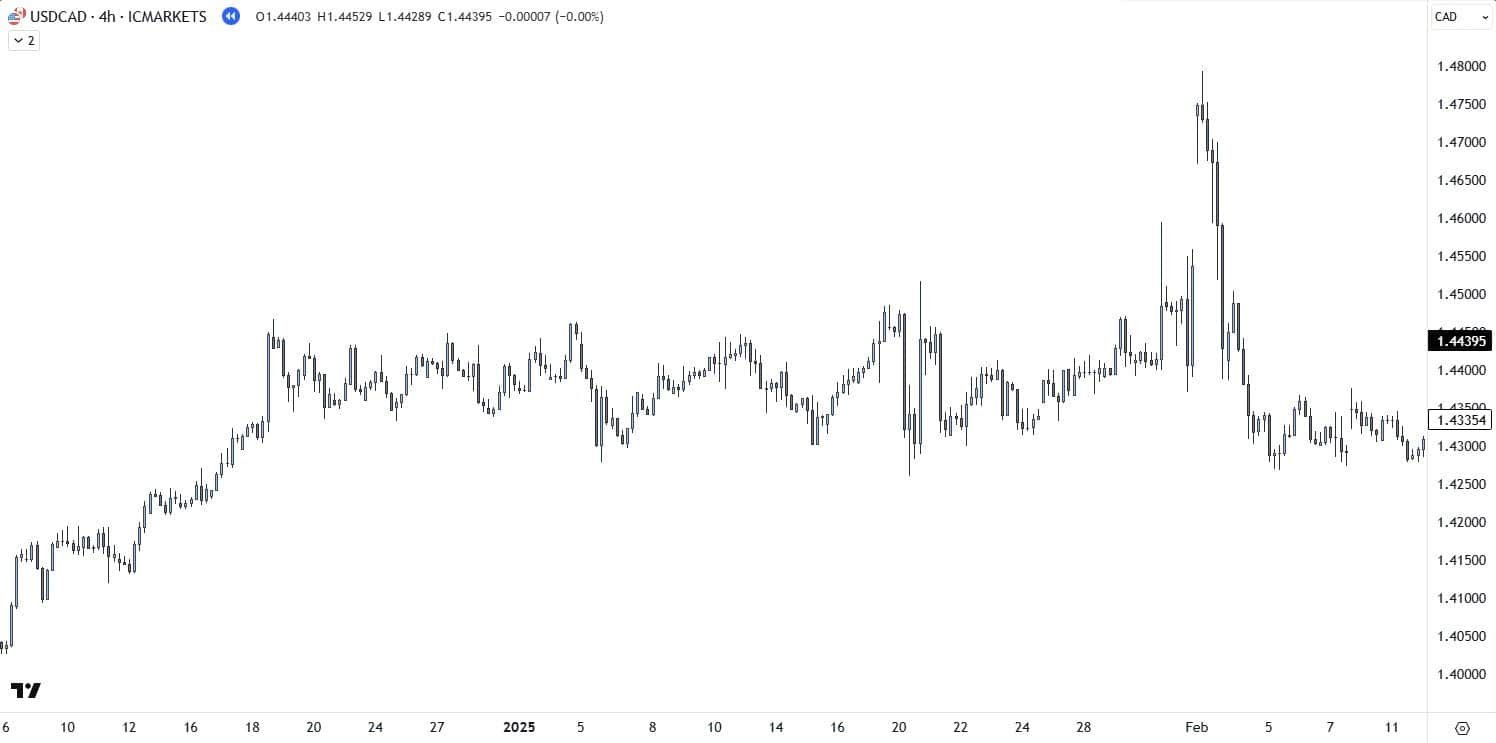

CISD pin-points when price delivery flips from accumulation to expansion. Learn how to spot it, trade it, and manage risk – with live chart examples, videos, and downloadable tools. Standard Deviation Projections – ICT Concepts In this educational video, the concept of Change in State of Delivery (CISD) is broken down through the lens of … Read more