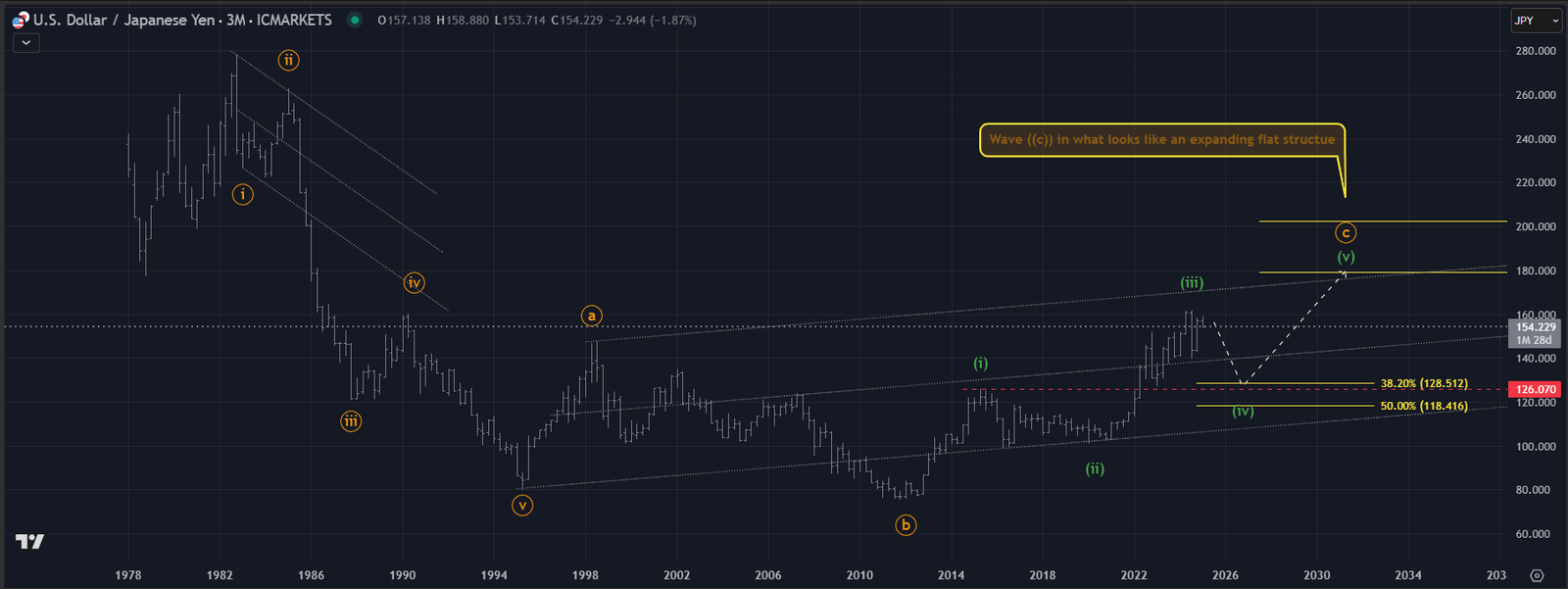

3-Month Elliott Wave Chart Analysis

Summary

This Elliott Wave chart analysis suggests that USD/JPY remains in a long-term bullish trend, respecting an established base channel.

- The market appears to have completed a Wave ((iv)) correction, aligning with the 38.2% Fibonacci retracement (128.72).

- According to this Elliott Wave analysis, USD/JPY is likely beginning Wave ((v)), which is expected to unfold in a five-wave impulsive structure.

? Key Confirmation Levels

✔ Break above Wave ① high → Confirms bullish continuation toward 161.56 and 180.90.

❌ Drop below 128.72 → Invalidates the wave count, suggesting a larger correction.

? Projected Price Targets

- Near-Term Resistance: 149.62 (previous Wave ((iii)) high).

- Mid-Term Target: 161.56 (1.236 Fibonacci extension).

- Long-Term Extension: 180.90 (1.618 Fibonacci extension).

? Market Bias

✅ Bullish Outlook: As long as price remains above 141.39 – 128.72, the wave count remains valid.

? Bearish Risk: A drop below 128.72 could indicate a larger corrective structure before continuation.

? This Elliott Wave chart analysis highlights USD/JPY’s potential for further upside, with Wave ((v)) projected to extend toward 161.56 – 180.90, contingent on price maintaining support within key Fibonacci levels. on the price maintaining support within key Fibonacci levels.

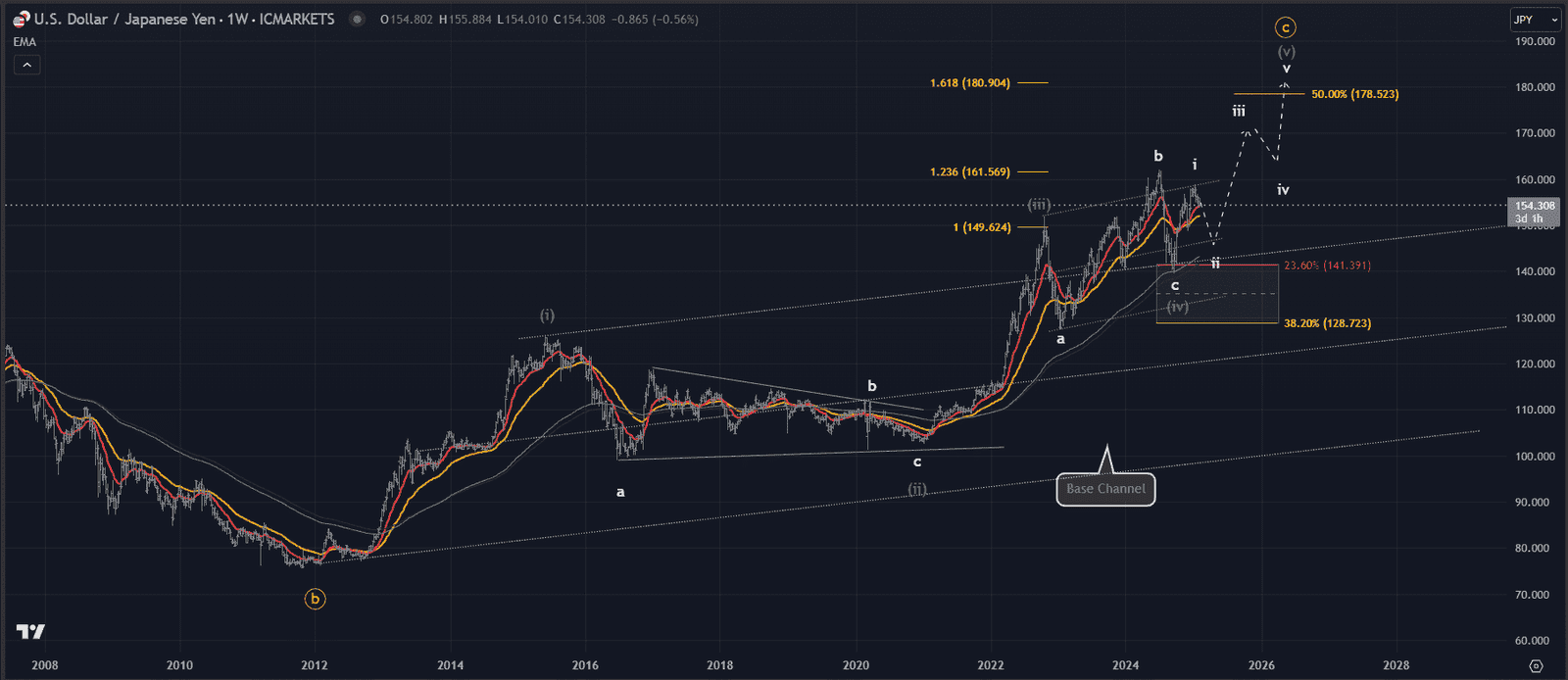

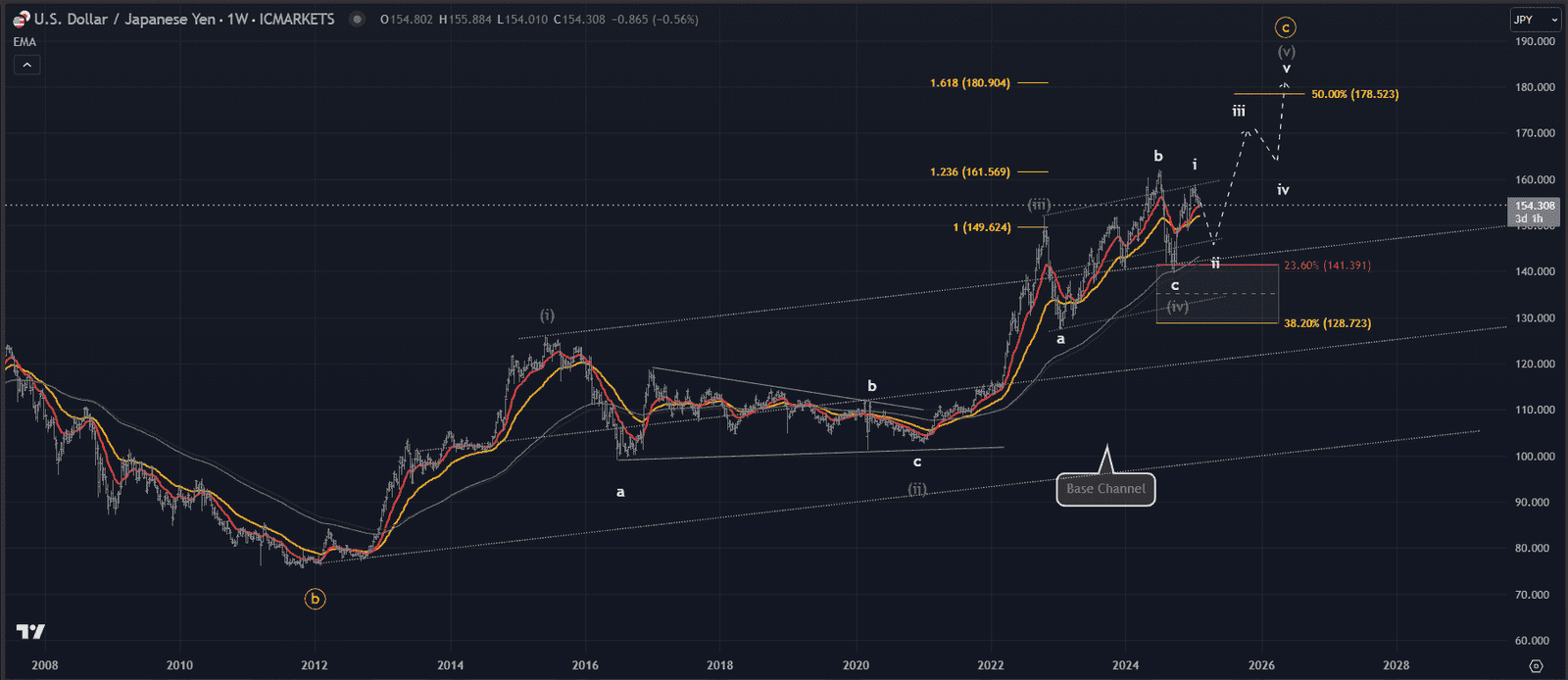

USD/JPY Weekly Outlook – Elliott Wave Analysis

USD/JPY Weekly Outlook – Elliott Wave Analysis

Current Market Structure

- This Elliott Wave analysis of USD/JPY suggests the market remains in a bullish long-term trend, respecting an established base channel.

- The chart highlights a completed Wave ((iv)) correction, setting the stage for the next leg higher.

- The expanding flat correction suggests Wave c found support near 128.72, aligning with Fibonacci confluence.

? Key Confirmation Levels

✔ Break above Wave ① high → Confirms the bullish structure and targets 161.56 – 180.90.

❌ Drop below 128.72 → Invalidates the bullish count and suggests a deeper correction.

? Potential Price Targets

- Near-Term Resistance: 149.62 (previous Wave ((iii)) high).

- Mid-Term Target: 161.56 (1.236 Fibonacci extension).

- Long-Term Extension: 180.90 (1.618 Fibonacci extension).

? Market Bias

✅ Bullish Outlook: As long as price remains above 141.39 – 128.72, this wave count remains valid.

? Deeper pullback below 128.72 could indicate a larger corrective structure before continuation.

? This Elliott Wave chart analysis suggests USD/JPY is in the early stages of Wave ((v)), with significant upside potential if the structure holds.

? Your Turn!

? What’s your outlook on USD/JPY? Do you think Wave ((v)) will reach 180.90?

Drop your thoughts in the comments below! ⬇️

? Want more Elliott Wave insights? Check out our latest Gold (XAU/USD) Elliott Wave Analysis and see how it correlates with USD/JPY.? Do you think Wave ((v)) will reach 180.90?

Drop your thoughts in the comments below! ⬇️