Summery

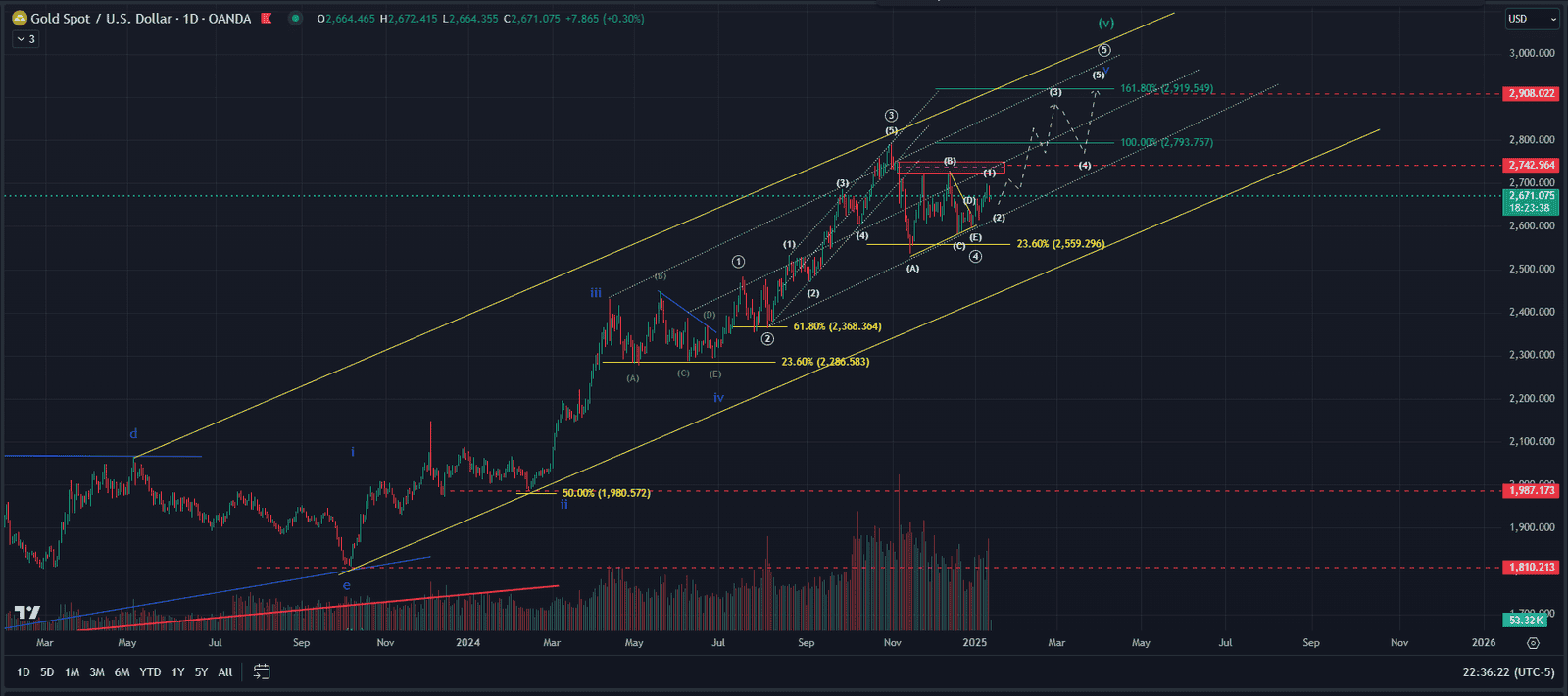

Current Status: In our latest gold Elliott wave analysis, gold prices have recently broken out of a corrective phase, suggesting we are now in Wave ((5)) of a fresh impulse. Potential upward movement could push gold prices to $2,919 per ounce, with the 161.8% Fibonacci extension level as a key target.

Resistance Level: Watch for resistance at the previous high of $2,793, which will be crucial in determining the continuation of the bullish scenario in our Elliott Wave analysis of gold.

Bearish Scenario: A rejection around $2,740 could signal a shift in market sentiment, potentially leading to a decline with a target of $2,340.

Gold prices have recently broken out of a corrective phase following their October 30 peak at $2,790 per ounce. After completing a clear five-wave sideways structure, there is a strong possibility that Wave 4 has been completed in the form of a contracting triangle.

Current price action suggests we are now in Wave ((5)) of a fresh impulse, which could push gold prices to $2,919 per ounce. This forecast is based on Fibonacci extension levels, with the 161.8% level acting as a potential target. However, the resistance at the previous high of $2,793, which coincides with the 100% extension level, will be key in determining whether the bullish scenario continues in our XAUUSD Elliott wave analysis.

Traders should watch for a potential rejection around the $2,740 level, as shown in the alternate bearish scenario.

Elliott Wave Analysis of Gold (Daily)

Should the bullish count hold, we expect to see a significant increase in volume to confirm the uptrend. In this scenario, there may be further buying opportunities at key levels over the next few months as Wave ((5)) completes. The estimated time for Wave ((5)) to fully unfold could be around three months, depending on market conditions.

Bearish Alternatives

A bearish alternative scenario should not be overlooked. If the price action invalidates the current bullish wave count, it could signal the start of a bearish decline. We will be monitoring the demand area to see if the price rejects at $2,740, which could confirm a shift in market sentiment and the completion of wave ((B)). This would set the stage for a potential decline, with a target of $2,340, aligning with the 38.2% Fibonacci level for wave ((C)).

Bearish Analysis (Daily)

Market participants should note that this technical analysis comes amid broader macroeconomic uncertainties, including Federal Reserve policy decisions and global inflation trends, which could impact gold’s price trajectory.