📖 Introduction

Forex trading requires a solid understanding of price charts to analyse market movements and make informed trading decisions. Whether you’re a beginner or an experienced trader, mastering chart types and patterns is crucial for technical analysis.

This guide covers:

- 📊 Different Types of Forex Charts (Line, Bar, Candlestick, and Renko)

- 🔍 How to Interpret Price Movements

- 📈 Chart Patterns & Trading Signals

🔢 1. Types of Forex Charts

Different chart types provide unique ways to visualize price movements.

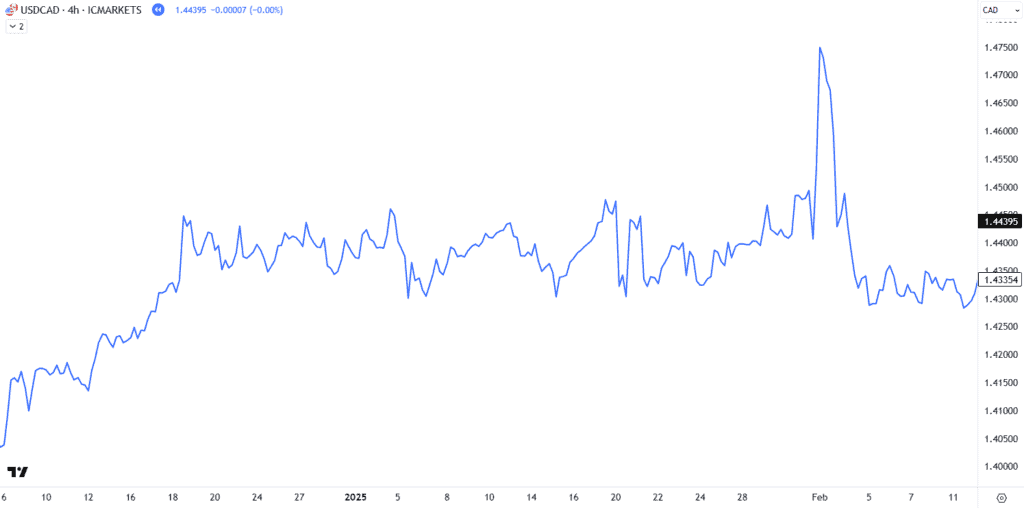

📉 Line Chart (Simple & Clear)

- Displays a single line connecting closing prices over time.

- Best for identifying long-term trends.

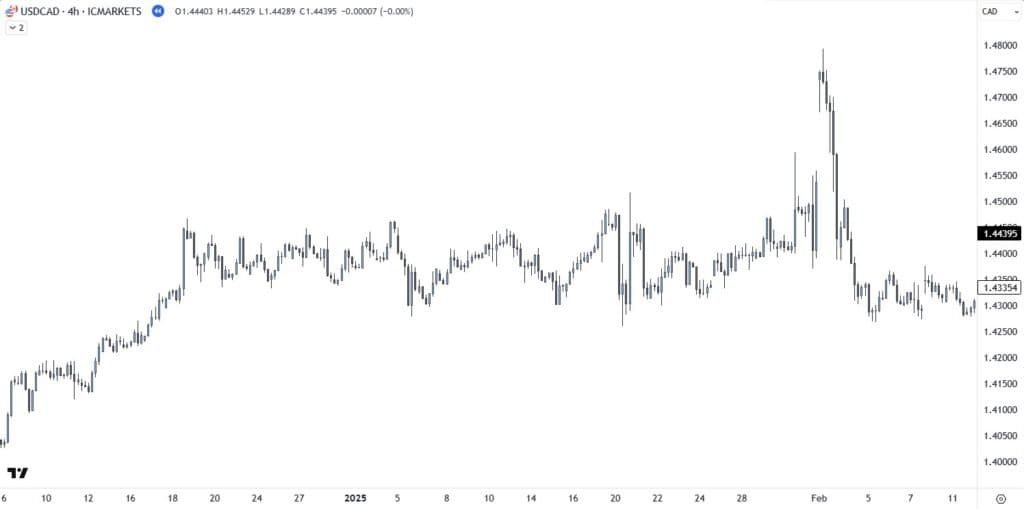

📊 Bar Chart (More Detailed)

- Shows open, high, low, and close prices (OHLC) for each time period.

- Each bar represents a trading session (hour, day, etc.).

- Provides more detail than a line chart but lacks visual candlestick patterns.

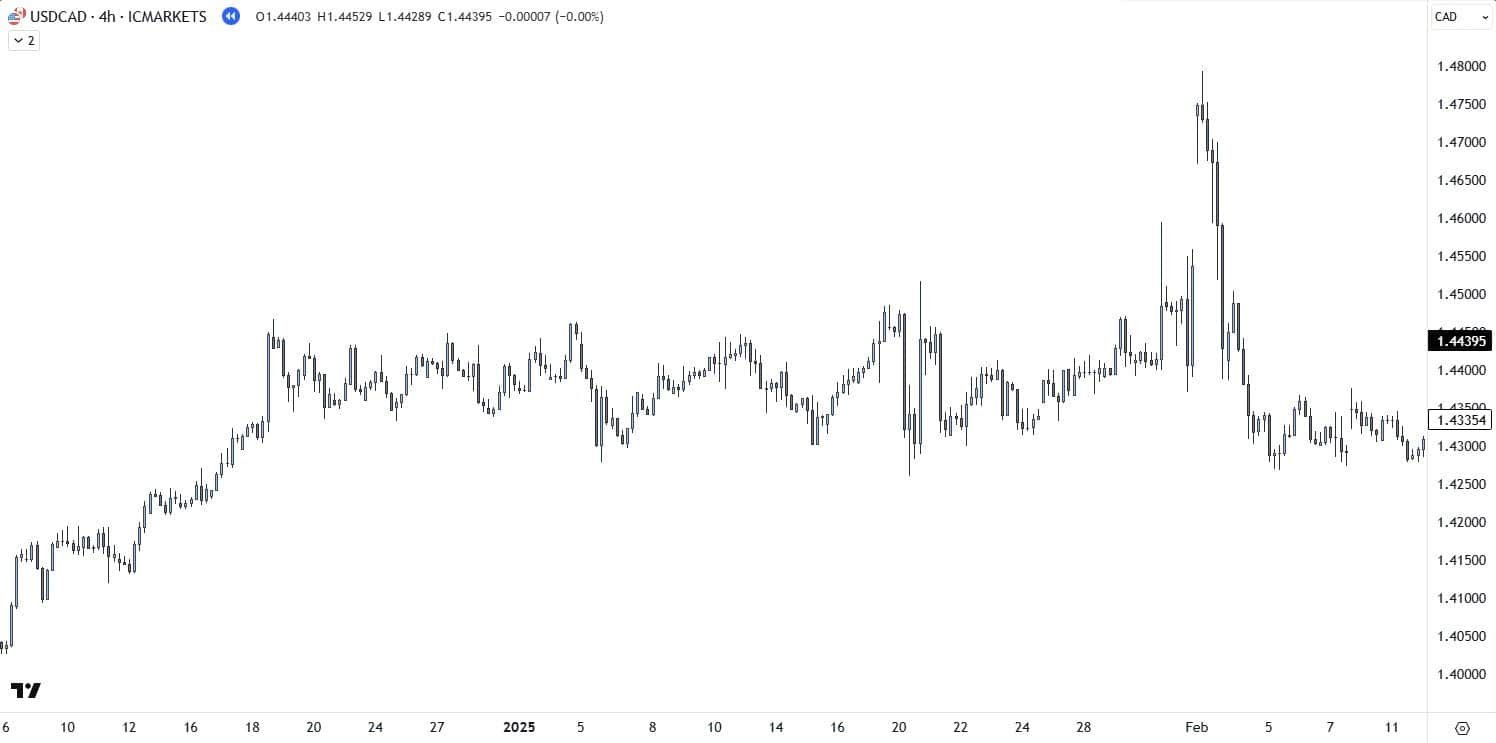

📈 Candlestick Chart (Most Popular & Widely Used)

- Each candlestick represents open, close, high, and low prices.

- Green (or white) candles = Bullish (price closed higher).

- Red (or black) candles = Bearish (price closed lower).

🔄 Renko Chart (Trend-Focused)

- Filters out market noise, showing only significant price movements.

- Best for identifying strong trends without small fluctuations.

🔍 2. How to Interpret Forex Charts

Once you understand chart types, interpreting price action is key.

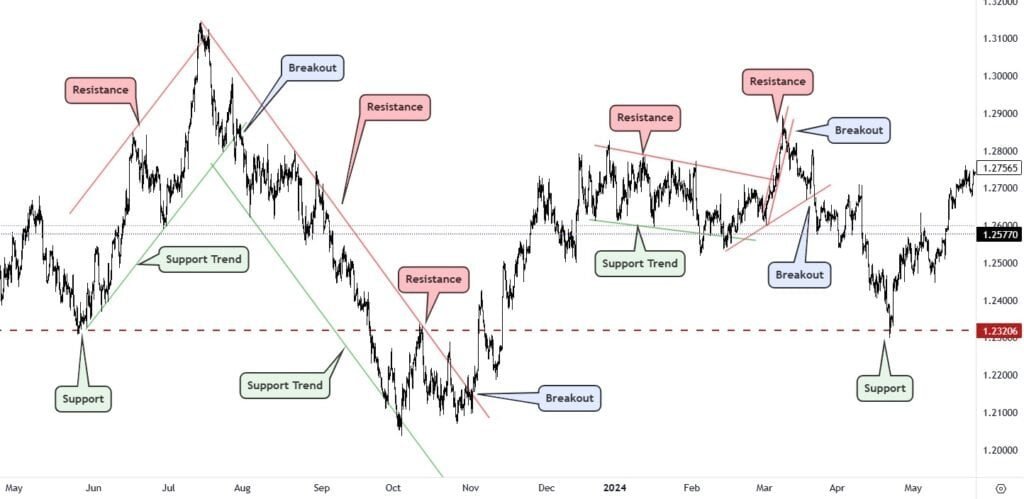

📏 Support & Resistance Levels

- Support: A price level where buying interest is strong.

- Resistance: A price level where selling interest is strong.

- Breakouts: When the price breaks through support or resistance levels.

📊 Trend Identification

- 🔼 Uptrend: Higher highs & higher lows.

- 🔽 Downtrend: Lower highs & lower lows.

- ➡️ Sideways Market: Price fluctuates in a range.

📈 3. Key Chart Patterns & Trading Signals

Chart patterns help traders predict market movements.

🔄 Reversal Patterns

- Head & Shoulders: Signals a potential trend reversal.

- Double Top/Bottom: Indicates strong resistance or support.

📐 Continuation Patterns

- Triangles (Ascending, Descending, Symmetrical): Price consolidates before continuing the trend.

- Flags & Pennants: Indicate strong momentum continuation.

📊 Image Suggestion: A trading pattern cheat sheet with common chart formations.

🛡️ 4. Setting Stop-Loss & Take-Profit

Risk management strategies rely on pip calculations and price levels for proper trade execution.

🚫 Stop-Loss Placement

- Set below support levels in an uptrend and above resistance levels in a downtrend.

- Use ATR (Average True Range) to determine optimal stop levels.

💰 Take-Profit Placement

- Set near major resistance in an uptrend and major support in a downtrend.

- Consider Risk-to-Reward Ratios (e.g., 1:2 or 1:3) for better trade management.

🎯 Conclusion

Understanding forex charts is essential for analysing price action, identifying trends, and making trading decisions. Mastering chart types, key patterns, and support/resistance will improve your technical analysis skills.

📘 Next Topic: Risk Management

Are you ready to master reading forex charts and enhance your trading strategy? 🚀